Students Advised to Prioritize Savings and Budgeting

Desmond Bredu, Head of Client Coverage at SIMS, has advised students to prioritize savings and budgeting and make it a habit.

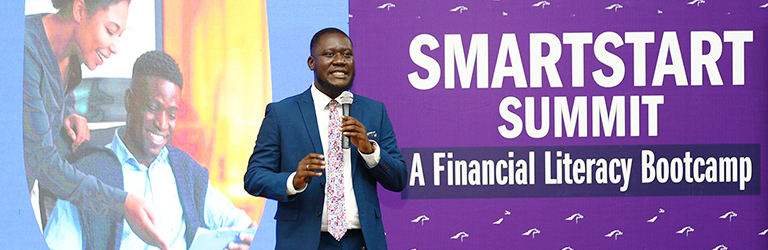

He said this at the SmartStart Summit organized by Enterprise Trustees in collaboration with The MoneyHub and the University of Ghana Business School (UGBS). The event centered around the theme “Empowering Tomorrow’s Leaders for Financial Success.”

Desmond Bredu opened his talk by clarifying the difference between saving and investing, emphasizing that “savings is deferred consumption; setting aside money for future needs, while investment is buying assets or securities, expecting a return.” He urged the students to prioritize saving before spending, stressing the need to save with the intention of investing.

To optimize savings, Mr. Bredu suggested practical steps such as increasing income, reducing expenses, automating savings, and tracking expenses. He highlighted the importance of having an accountability partner and avoiding impulse buying, while also stressing the necessity of distinguishing between fixed and variable expenses in budgeting. "Budgeting is telling your money where it should go rather than wondering where it went," he remarked, advocating for the 50/30/20 rule to allocate income effectively.

He stated that this meant allocating 50% of your income to your needs, 30% to your wants, and 20% to your savings and investments. He however emphasized that this formula may not suit all situations and that the student needs to find one that best suits their unique circumstances. He further encouraged them to be diligent and consistent with the portion they allocate for their savings and investments.

Despite the current economic uncertainties, Desmond Bredu encouraged the students to consider investments, presenting it as a key strategy for achieving financial independence and protecting against inflation. He outlined the significance of aligning investments with personal goals, whether for retirement, starting a business, or emergency funds. Mr. Bredu also explained the nature of investment risks, distinguishing between systematic risks affecting the entire market and unsystematic risks specific to sectors or companies, which can be mitigated through diversification.

Using a case study, Desmond Bredu illustrated the time value of money by comparing two different investment strategies, demonstrating how early and consistent investing leads to greater returns. He concluded with reflections on financial improvement, emphasizing the importance of risk tolerance, due diligence, and starting to invest as soon as possible. The SmartStart event provided attendees with practical financial knowledge, empowering them to make informed decisions for their future financial success.